An escalating volume of content offerings, combined with the demand for higher video resolutions, will further the expansion of network bandwidth of streamed video.

The migration from 720 and 1080p video to UHD 4k and higher video resolutions won’t necessarily be the dominant driver but is an important accelerant. Just because a subscriber has a 4K or 8K wall monitor in the living room, does not mean that most of the content viewed will be UHD.

The takeaway is that the need for bandwidth and network infrastructure is big and growing.

74% of US household have an VoD service, and almost 69% of all households have more than one service. (Liechman Research Group, 2019) Many households have more than one Set Top Box device.

The reach of VoD is larger than the subscriptions numbers would imply. Roughly 20% of these subscriptions are shared with others outside of their household. Grandma does not have a Netflix subscription, but she does have a Roku Device. Go figure!

An increasing share of the VoD is turning to Original Content from the biggest Content Service Providers. The trend is led by Netflix, Amazon, and HBO today, soon to be followed aggressively by Disney, Apple, AT&T and others. This fresh content plumps up the “Fat Tail” volume, relative to more matured longer tailed offerings.

Derived from Cisco’s 2019 VNI forecast, VoD network traffic delivered to TVs alone will top 83×1018 B/month by 2022. (Cisco, 2019) The USA represents roughly half of this. It is expected to hold a constant 61% share of Global IP video traffic, itself growing at greater than 30% Compounded Annual Growth Rate [CAGR].

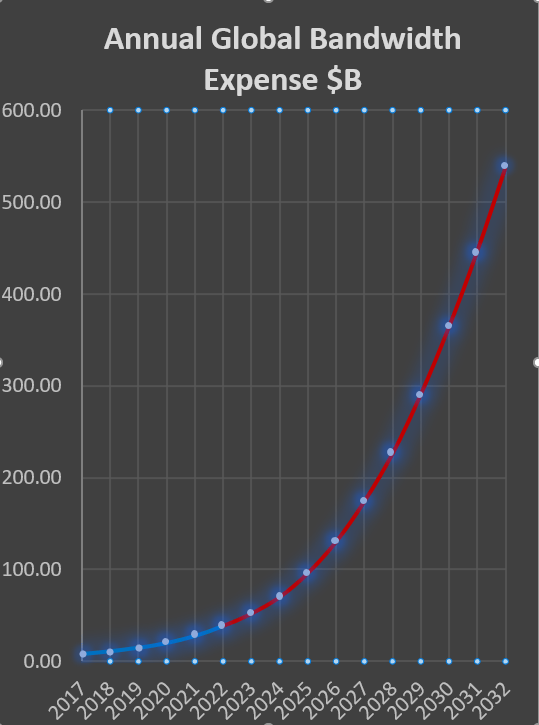

From this forecast, at at burdened bandwidth rates of $2,780 / Gbps /month, annual VoD delivery bandwidth costs will be quite significant.

Your mileage may vary, scale this up or down if your expectation of bandwidth cost differs.